Westpac ICPU Project

Using Digital Technologies to Improve User Experience

Team

Violet & Co. Digital Solutions makes up of 5 members. Each member possesses different experiences, and disciplines, with one goal to produce a well-researched problem and feasible solution for Westpac.

UX Research

Trend Research

Customer Personas

Budget Planner Prototype

Presentation Designer

Plan Report Designer

Responsibilities

Deliverables

If you worked at Westpac, how would you delight your customers with an innovative digital solution?

Identify promising solutions in the digital technology space and evaluate their suitability for a successful implementation in the Australian context for Westpac.

Task

As the Millennial and Generation Z populations begin to age they are rapidly becoming a large source of the world's generational and acquired wealth. As a result, traditional retail banks like Westpac must continue to adapt and develop new technology to meet the needs of this growing consumer market. Furthermore, in the wake of the current worldwide pandemic, customers are interacting with financial technologies more than ever, gradually shifting away from physical branches in favor of online outlets.

Future of Banking

Violet & Co. Digital Solutions (Violet & Co.) proposes the development of an in-app financial planning tool in the form of a budget planner.

Proposal

1 | Pain Points

The Current Budget Planner

Comparatively to the Westpac App and Website Design, the Budget Planner lacks consistency with the current design and personalization to consumer’s needs and lifestyles.

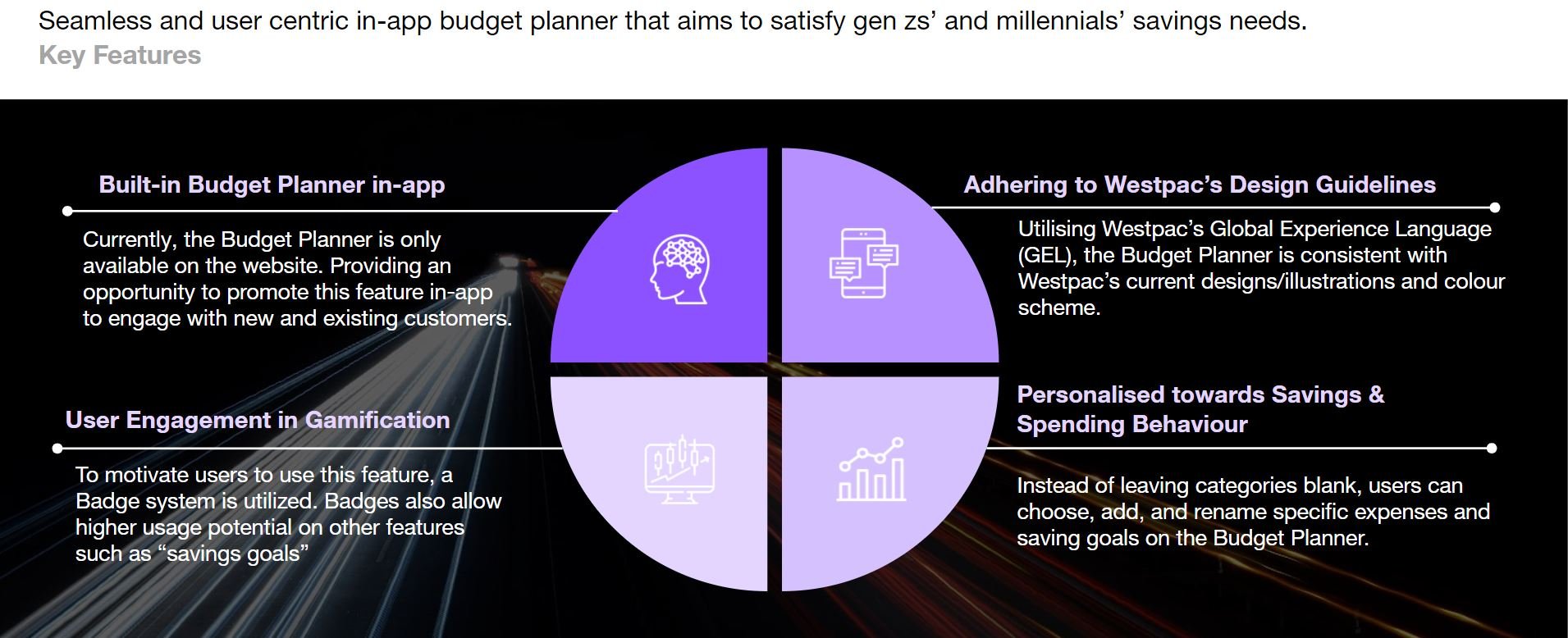

2 | Proposed Solution

How can we enhance Gen zs’ and Millenial’s in-app savings behavior, as well as improve visual appeal to Westpac’s current resources?

A budget planner that focuses on taking the customer step-by-step by visually representing information and allowing customization in-app

Discover our Solution

We are only to focus Anna’s journey using the Budget Planner

Target Market

The solution is catered to 3 behavioral groups:

Uncertain Savers: not confident about their spending and saving habits

Saving Enthusiasts: semi-confident and are discovering new money management tools

Saving Experts: confident about money management and spending

How Does it Work?

Through Anna’s journey, a few key features are highlighted:

Planner is built in-app while currently, it is only available on the Westpac Website.

Design adheres closer to Westpac’s Global Experience Language.

Implementing gamification helps especially ‘Uncertain Saver’s to feel a sense of achievement as a learner.

A stronger degree of personalization, where users can pick, choose, and create their own expenses categories and saving goals’ names. Our aim from these key features is to change users’ mindset of “having to save” to “wanting to save”

Key Features

3 | Research

Supporting Evidence & Findings

4 | Risk & Mitigation Strategies

5 | Implementation Strategy

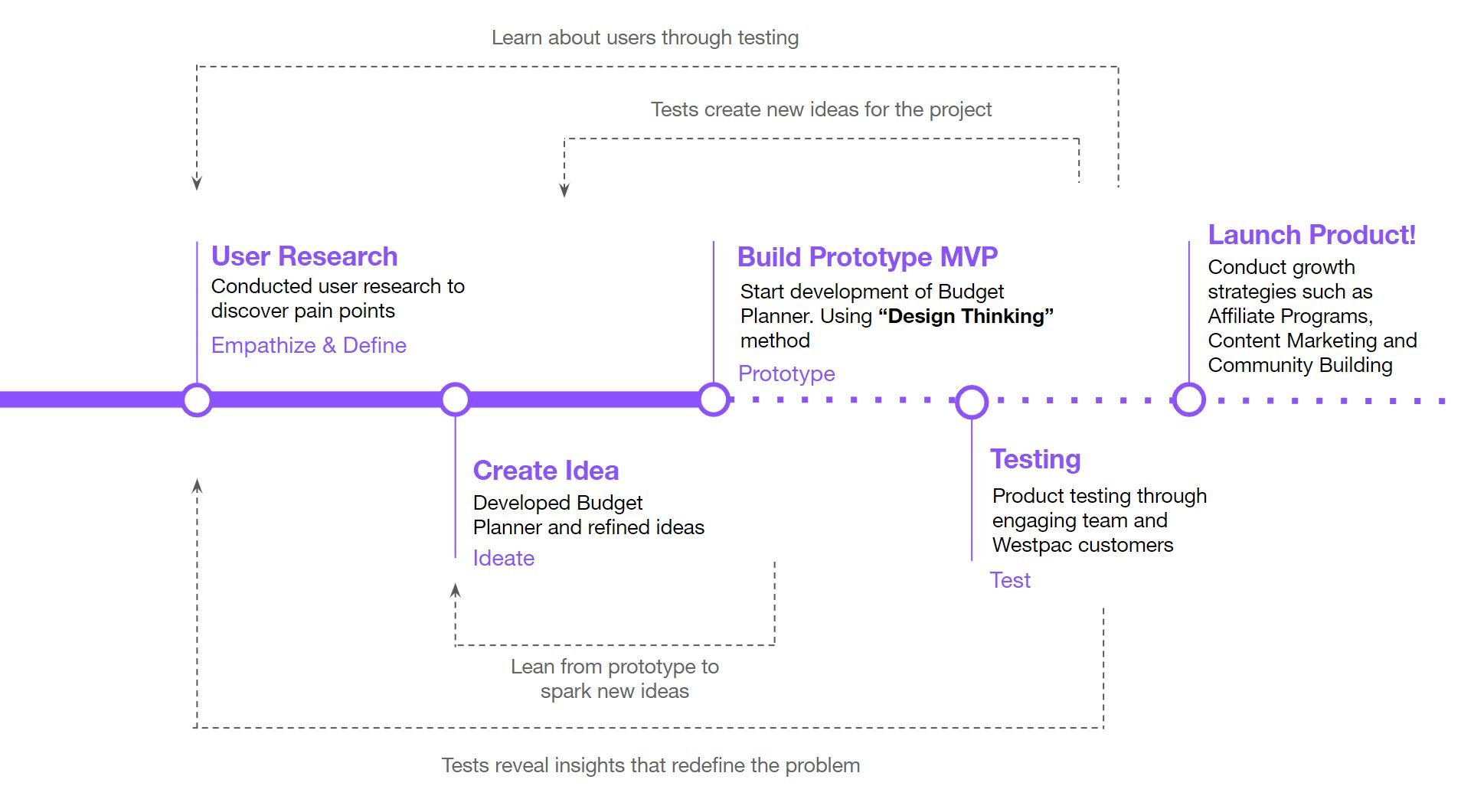

To adhere to the mitigation strategies effectively, our team devised an implementation strategy of the proposed solution. Violet & Co. Digital Solutions completed the first iteration of User Research, Idea Creation, and Built a Minimum Viable Product (MVP) prototype. For the second iteration, a refined prototype will be created to go through testing internally within Westpac and externally with customers. Finally, launch the product and conduct growth strategies.